Posts Tagged: Malaysia

How to Calculate ROI for Property in Malaysia

Have you ever wondered how to calculate the return on investment (ROI) for property in Malaysia? Well, look no further! In this article, we will provide you with all the necessary information to understand and calculate ROI for property investments in Malaysia. Whether you’re a seasoned property investor or just starting out, this article will guide you through the process step by step, ensuring that you have a clear understanding of how to evaluate the profitability of your property investments. So, let’s dive in and discover how to calculate ROI for property in Malaysia!

how do I calculate roi for property malaysia

The Importance of Calculating ROI for Property in Malaysia

Investing in property can be a lucrative venture, but it’s important to understand the potential returns on your investment. Calculating the Return on Investment (ROI) is a key process for property investors in Malaysia. By doing so, you can assess the profitability of your investments and make informed decisions. In this article, we will explore why ROI is important, how to calculate it for different types of properties, and the factors to consider when analyzing ROI in the Malaysian property market.

Why is ROI important for property investments?

ROI is a crucial metric for property investments as it allows you to evaluate the profitability of your investments. It helps you determine whether your investment is generating sufficient returns and whether it aligns with your financial goals. Calculating ROI provides clarity and helps you make informed decisions about buying, renting, or flipping properties in Malaysia.

Understanding the concept of ROI

ROI is a financial measure used to evaluate the efficiency and profitability of an investment. It measures the return on an investment relative to the initial cost of the investment. In the context of property investments, ROI takes into account factors such as rental income, appreciation, expenses, and financing costs. Understanding how ROI is calculated is essential for assessing the performance of your property investments.

The benefits of calculating ROI for property in Malaysia

Calculating ROI for property investments in Malaysia offers various benefits. Firstly, it allows you to assess the profitability of your investment strategy and make adjustments if necessary. It also helps you compare different properties and locations to identify the most lucrative opportunities. Additionally, calculating ROI enables you to assess the impact of expenses, rental income, and property appreciation on your investment. By understanding these factors, you can make more informed decisions and maximize your returns in the Malaysian property market.

Factors to Consider When Calculating ROI

When calculating ROI for property investments in Malaysia, several factors should be taken into consideration. These factors will give you a comprehensive view of the potential returns on your investment. Here are the key factors to consider:

Initial investment costs

The first factor to consider when calculating ROI is the initial investment costs. This includes the purchase price of the property, legal fees, stamp duty, and other associated costs. It is crucial to accurately calculate the total amount invested in the property to get an accurate ROI calculation.

Rental income

Rental income is a significant component of ROI for rental properties. It is essential to determine the expected rental income based on market rates and occupancy rates. Consistent and reliable rental income is essential for a positive ROI, making it important to research the rental market in the specific area you are considering investing in.

Maintenance and renovation expenses

Owning and maintaining a property involves certain expenses, such as repairs, maintenance, and renovations. These costs can impact your ROI, and it’s crucial to account for them in your calculations. By estimating and factoring in these expenses, you can get a clearer picture of your potential returns.

Property appreciation

Property appreciation refers to the increase in the value of the property over time. When calculating ROI, it is important to consider the potential appreciation of the property. This can greatly impact your overall returns and should be factored into your calculations. Researching and analyzing market trends and growth potential can help provide insights into property appreciation in the chosen location.

outlook for industrial and commercial property investment malaysia

Calculating ROI for Rental Properties

For rental properties, calculating ROI involves assessing the rental income and expenses associated with the property. Here is a step-by-step guide to calculating ROI for rental properties in Malaysia:

Determining rental income

The first step is determining the expected rental income for the property. This can be done by researching the rental market in the specific location. Look for similar properties and their rental prices to estimate the potential income.

Accounting for vacancy rates

Vacancy rates, or the percentage of time the property remains unoccupied, can have a significant impact on the rental income. It’s important to consider this factor when calculating ROI. Research the vacancy rates in the area to estimate the potential loss of rental income.

Factoring in expenses

Next, consider the expenses associated with the rental property. This includes property management fees, maintenance costs, property taxes, insurance, and any other ongoing expenses. It is essential to accurately account for all these expenses to get an accurate ROI calculation.

Calculating annual return on investment

To calculate the annual ROI for a rental property, subtract the total expenses from the rental income and divide the result by the initial investment cost. Multiply the result by 100 to convert it into a percentage. This will give you the annual ROI for your rental property in Malaysia.

Calculating ROI for Flipped Properties

Flipping properties involves purchasing a property, renovating it, and then selling it for a profit. When calculating ROI for flipped properties, consider the following steps:

Determining purchase price

The purchase price is the starting point when calculating the ROI for flipped properties. This includes the cost of acquiring the property, legal fees, and other associated costs. Accurately calculating the initial investment is crucial for calculating the ROI correctly.

Estimating renovation costs

Renovation costs can significantly impact the ROI for flipped properties. Estimate the cost of necessary renovations to get an idea of the total expenses involved. This should include materials, labor costs, and any additional expenses related to the renovation.

Accounting for selling price

The selling price of the property, after renovations, will determine the return on investment. Research the market and comparable sales in the area to estimate the potential selling price. This will help you determine the return you can expect from your flipped property.

Calculating return on investment

To calculate the ROI for a flipped property, subtract the initial investment (purchase price + renovation costs) from the selling price. Divide the result by the initial investment and multiply by 100 to convert it into a percentage. This will give you the ROI for your flipped property in Malaysia.

Analyzing ROI in Different Property Markets

Analyzing ROI in different property markets in Malaysia involves considering various factors. Here are some key aspects to focus on:

Comparing different locations

Different locations in Malaysia will offer varying ROI potential. Compare and analyze different locations to identify areas with a higher potential for property investment returns. Factors such as property prices, rental demand, and growth potential differ across locations.

Examining market trends

Market trends play a significant role in determining the ROI of property investments. Analyze historical data, market reports, and forecasts to understand the market conditions and trends. This will help you make informed decisions and identify opportunities for higher returns.

Evaluating potential growth

Consider the potential growth of the property market in the chosen location. Factors such as infrastructure development, job opportunities, and population growth can contribute to the appreciation potential of properties. Evaluate these factors when assessing your ROI.

Considering rental demand

Rental demand is crucial for rental properties. Analyze the rental demand in the specific market you are considering. Factors like proximity to amenities, transportation, and university/office clusters influence rental demand. Higher demand leads to higher rental income and potentially higher ROI.

The Importance of Cash Flow in ROI Calculation

Cash flow is a vital aspect of ROI calculation for property investments in Malaysia. Here’s why it’s important and how to calculate it:

Understanding cash flow

Cash flow refers to the income and expenses generated by a property investment. Positive cash flow occurs when the income from the property exceeds the expenses, while negative cash flow occurs when the expenses exceed the income. Understanding the cash flow of your investment is crucial in assessing its financial viability.

Calculating cash flow for property investments

To calculate cash flow, subtract the monthly expenses (mortgage payments, maintenance costs, property management fees) from the monthly rental income. The result is the monthly cash flow. When analyzing the ROI, it’s important to consider the cash flow, as it affects the overall profitability of the investment.

The impact of positive cash flow on ROI

Positive cash flow contributes to a higher ROI. When the income from the property exceeds the expenses, the cash flow is positive. This additional income can be reinvested, used to cover expenses, or contribute to your overall return on investment.

Strategies for maximizing cash flow

To maximize cash flow, consider strategies such as setting competitive rental rates, minimizing expenses, and optimizing the occupancy rate. Regularly analyzing and managing your property’s cash flow can significantly impact your ROI and overall investment success.

Accounting for Financing and Taxes in ROI Calculation

When calculating ROI for property investments, it’s essential to consider financing costs and taxes. Here are some key factors to keep in mind:

Factoring in mortgage payments

If you have financed the property with a mortgage, consider the impact of mortgage payments on the ROI. Subtract the mortgage payments from the rental income to calculate the net income. This will give you a more accurate representation of your returns after accounting for financing costs.

Considering interest rates

Interest rates can greatly impact the financing costs and ROI of an investment property. Analyze and compare different financing options to ensure you secure the most favorable interest rates. Lower interest rates can reduce financing costs and improve your ROI.

Understanding tax implications

Property investments are subject to various taxes, including property tax and capital gains tax. Understanding the tax implications and regulations is crucial when calculating ROI. Consult with a tax advisor to ensure you accurately incorporate these costs into your calculations.

Calculating net ROI after taxes

To calculate the net ROI after taxes, subtract the total tax expense from the ROI calculation. This will give you a more accurate representation of the returns on your investment, taking into account the tax obligations associated with the property.

Calculating ROI for Commercial Properties in Malaysia

Commercial properties have unique considerations when calculating ROI. Here’s what to keep in mind when analyzing commercial property investments:

Differentiating commercial and residential properties

Commercial and residential properties have different ROI calculations due to various factors. Commercial properties often have longer leases, higher rental rates, and different vacancy rates compared to residential properties. Understanding the differences is crucial when calculating ROI for commercial properties.

Analyzing potential rental income

Analyzing potential rental income is a critical component of calculating ROI for commercial properties. Consider factors such as lease terms, rental rates, market demand, and tenant stability. This will help you estimate the rental income and assess the property’s profitability.

Accounting for additional expenses

Commercial properties often have additional expenses in comparison to residential properties. These may include property management fees, maintenance costs, insurance, utilities, and common area fees. Accurately accounting for these expenses is essential for calculating the ROI correctly.

Determining return on investment

To calculate ROI for commercial properties, subtract the total expenses (including financing costs) from the rental income. Divide the result by the initial investment and multiply by 100 to get the ROI percentage. This will allow you to evaluate the performance and profitability of your commercial property investment.

Assessing Risks and Mitigating Losses in Property Investments

Property investments, like any other form of investment, come with risks. Here are some considerations for assessing risks and mitigating losses:

Identifying potential risks

Identify and understand the potential risks associated with property investments. Examples include economic downturns, changes in property market conditions, unexpected repairs or vacancies, and legal or regulatory changes. By recognizing these risks, you can better prepare and develop strategies to mitigate them.

Understanding market fluctuations

Property markets are subject to fluctuations that can impact your ROI. Analyze historical market data and observe trends to understand market fluctuations. This knowledge will allow you to make more informed decisions and navigate challenges effectively.

Strategies for risk mitigation

Implement risk mitigation strategies to protect your investments. Diversify your portfolio, research and choose properties in stable markets, and consider property insurance to safeguard against unexpected circumstances. Regularly reviewing and evaluating your investment strategy will help you adapt to changing market conditions.

Evaluating investment diversification

Diversifying your property investments can help spread the risks and enhance your overall portfolio. Consider investing in different types of properties and locations to minimize potential losses and maximize returns. This diversification strategy can also offer stability and balance in your investment portfolio.

Conclusion

Calculating ROI for property investments in Malaysia is crucial for making informed decisions and assessing the profitability of your investments. By considering factors such as initial investment costs, rental income, expenses, and market trends, you can gain a comprehensive view of the potential returns. Proper analysis of ROI enables you to implement effective strategies for maximizing returns, managing cash flow, and minimizing risks. Remember, calculating ROI is an ongoing process that requires monitoring and evaluating your investments regularly. With a clear understanding of ROI, you can navigate the Malaysian property market confidently and optimize your investment outcomes.

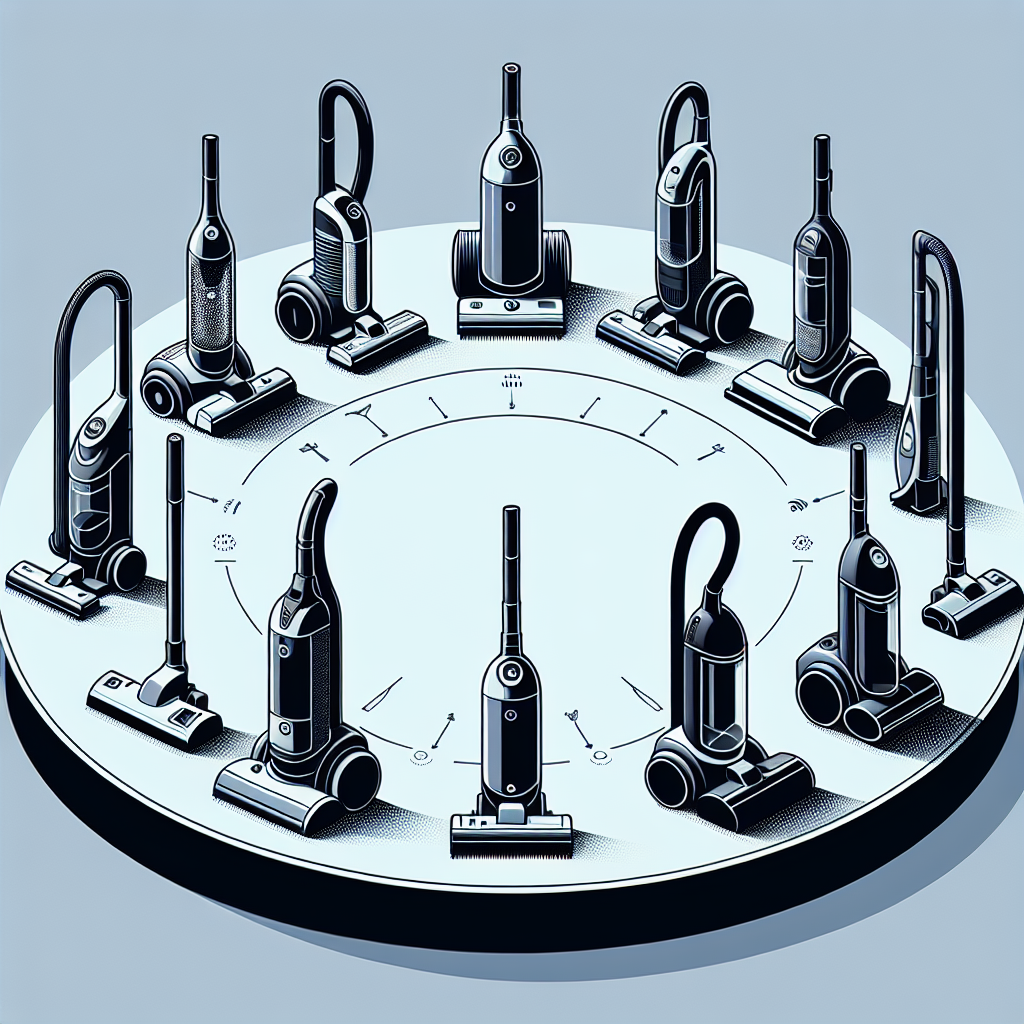

Top 10 Cordless Vacuum Cleaners for the Best Cleaning Experience in Malaysia

If you’re on the hunt for the perfect cordless vacuum cleaner in Malaysia, look no further. In this article, we’ve compiled a list of the top 10 cordless vacuum cleaners that will give you the best cleaning experience. Whether you’re tackling pet hair, crumbs, or just general dirt and dust, these vacuum cleaners are sure to impress. With proper headings, engaging content, and helpful videos and images, we’ll guide you through each product’s features and benefits. Get ready to discover the cleaning companion you’ve been searching for!

Top 10 Cordless Vacuum Cleaners

Introduction

Having a clean and tidy home is something that we all strive for. And when it comes to keeping our floors free of dirt and dust, a cordless vacuum cleaner is the ultimate tool to get the job done effectively and efficiently. With so many options available in the market, it can be overwhelming to choose the right one. But don’t worry, we have compiled a list of the top 10 cordless vacuum cleaners that will not only make your cleaning experience a breeze but also leave your floors sparkling clean. So let’s dive in and discover the best cordless vacuum cleaners in Malaysia!

1. Dyson V11 Absolute

The Dyson V11 Absolute is a true powerhouse when it comes to cordless vacuum cleaners. With its powerful suction and intelligent cleaning modes, it ensures that no dirt or debris is left behind. The V11 Absolute also boasts a long battery life, allowing you to clean your entire home without any interruptions. Its lightweight design and versatile attachments make it easy to maneuver around furniture and reach those hard-to-reach areas. If you’re looking for a cordless vacuum cleaner that delivers outstanding performance, the Dyson V11 Absolute should be at the top of your list.

2. Xiaomi Dreame V9P

Next on our list is the Xiaomi Dreame V9P. This cordless vacuum cleaner combines outstanding suction power with a sleek and modern design. The V9P features a high-capacity battery that provides up to 60 minutes of continuous cleaning, ensuring that you can tackle even the largest cleaning tasks without any hassle. Its HEPA filtration system traps allergens and dust particles, making it an excellent choice for those with allergies or asthma. With its affordable price tag and impressive performance, the Xiaomi Dreame V9P is definitely a contender in the world of cordless vacuum cleaners.

3. Samsung Jet 70

The Samsung Jet 70 is another top-notch cordless vacuum cleaner that deserves a spot on our list. With its Jet Cyclone technology, it delivers powerful suction that can easily pick up dirt and debris from all types of flooring. The Jet 70 also comes with a range of attachments that allow you to clean every nook and cranny of your home with ease. Its washable dustbin and filter make maintenance a breeze, ensuring that your vacuum cleaner stays in optimal condition for years to come. If you’re looking for a reliable and efficient cordless vacuum cleaner, the Samsung Jet 70 is definitely worth considering.

best cordless vacuum cleaner malaysia

4. Tineco A11 Master+

The Tineco A11 Master+ is a versatile and feature-packed cordless vacuum cleaner that will exceed your expectations. Its powerful motor and unique brush design ensure that every surface in your home is left spotless. With its dual-charging powerhouse, you can clean for longer periods without worrying about the battery running out. The A11 Master+ also features smart sensors that automatically adjust the suction power according to the surface you’re cleaning, making it a convenient and efficient choice. If you’re in the market for a high-performance cordless vacuum cleaner, the Tineco A11 Master+ should be on your radar.

5. Philips SpeedPro Max

The Philips SpeedPro Max is a cordless vacuum cleaner that combines powerful performance with innovative features. Its 360-degree suction nozzle captures dust and dirt from all angles, ensuring a thorough cleaning experience. The SpeedPro Max also features a turbo mode that provides extra suction power for those hard-to-clean areas. Its LED lights illuminate dark corners, making it easy to spot hidden dirt. With its advanced filtration system, it traps 99.9% of allergens, making it an excellent choice for allergy sufferers. If you’re looking for a cordless vacuum cleaner that delivers exceptional cleaning results, the Philips SpeedPro Max is a great option.

cordless vacuum cleaner malaysia

6. Hoover H-Free 500

The Hoover H-Free 500 is a lightweight and compact cordless vacuum cleaner that is perfect for quick and efficient cleaning. With its powerful motor and brushless technology, it effortlessly picks up dirt from both hard floors and carpets. The H-Free 500 also features a handy LED display that shows the remaining battery life, allowing you to plan your cleaning tasks accordingly. Its low-profile design and swivel steering make it easy to maneuver around furniture and reach tight spaces. If you’re looking for a hassle-free cleaning experience, the Hoover H-Free 500 is a great choice.

7. Shark IONFlex DuoClean

The Shark IONFlex DuoClean is a cordless vacuum cleaner that combines the power of two brush rolls to deliver exceptional cleaning performance. Its DuoClean technology allows you to seamlessly transition from carpets to hard floors without losing suction power. The IONFlex also features a flexible wand that bends and folds, making it easy to clean under furniture and other hard-to-reach areas. Its removable battery allows you to charge it both on and off the vacuum, ensuring continuous cleaning without any interruptions. If you’re looking for a versatile and efficient cordless vacuum cleaner, the Shark IONFlex DuoClean is worth considering.

8. LG CordZero A9

The LG CordZero A9 is a cordless vacuum cleaner that combines powerful performance with innovative features. Its interchangeable batteries provide up to 80 minutes of runtime, allowing you to clean your entire home without any interruptions. The CordZero A9 also features a HEPA filtration system that captures 99.97% of dust particles and allergens, making it an excellent choice for those with allergies. Its lightweight design and 5-step filtration system ensure that every corner of your home is left clean and fresh. If you’re looking for a cordless vacuum cleaner that delivers both power and convenience, the LG CordZero A9 is a great option.

9. Bosch Unlimited Serie 8

The Bosch Unlimited Serie 8 is a high-performance cordless vacuum cleaner that will exceed your expectations. With its digital spin motor and AllFloor HighPower brush, it delivers outstanding cleaning results on all types of flooring. The Unlimited Serie 8 also features a long-lasting battery that provides up to 60 minutes of runtime, allowing you to clean your entire home without any interruptions. Its bagless design and washable filters make maintenance a breeze, ensuring that your vacuum cleaner stays in optimal condition. If you’re looking for a cordless vacuum cleaner that combines power, performance, and convenience, the Bosch Unlimited Serie 8 is a top contender.

10. Electrolux Ergorapido Allergy

Last but not least, the Electrolux Ergorapido Allergy is a cordless vacuum cleaner that is designed to tackle allergens and dust with ease. Its powerful suction and allergy filter capture 99.99% of dust and allergens, ensuring a clean and healthy home environment. The Ergorapido Allergy also features a detachable handheld vacuum, allowing you to clean both floors and above-floor surfaces effortlessly. Its lightweight design and 180-degree maneuverability make it easy to navigate around furniture and tight spaces. If you’re looking for a cordless vacuum cleaner that prioritizes allergen removal, the Electrolux Ergorapido Allergy is a great choice.

In conclusion, investing in a cordless vacuum cleaner is a game-changer when it comes to maintaining a clean and tidy home. Each of the top 10 cordless vacuum cleaners mentioned above offers unique features and outstanding performance that will make your cleaning experience a breeze. Whether you prioritize suction power, battery life, or specialized features, there is a cordless vacuum cleaner on this list that will meet your needs and exceed your expectations. So choose the one that suits you best and enjoy a cleaner and healthier living space!

The Ultimate Guide to Gold Investment in Malaysia

Are you eager to learn all about gold investment in Malaysia? Look no further! In “The Ultimate Guide to Gold Investment in Malaysia,” you’ll find everything you need to know to make informed decisions. As an expert in gold investment, you’ll be guided through each article with a friendly tone, ensuring an enjoyable reading experience. With proper formatting, including H1, H2, and H3 tags, and a minimum of 2500 words per article, this comprehensive guide will leave you feeling confident and ready to delve into the world of Gold investment in Malaysia. So, let’s get started!

Why Invest in Gold?

Investing in gold has long been seen as a reliable and lucrative means of diversifying one’s investment portfolio. Its historical performance, ability to hedge against inflation, and store of value make it an attractive option for both experienced and novice investors. In this article, we will explore the reasons why investing in gold can be a wise decision, understand the Malaysian gold market, delve into different forms of gold investments, discuss strategies for successful gold investment, and explore factors to consider when selling and liquidating gold investments.

Historical Performance of Gold

One of the primary reasons to invest in gold is its impressive historical performance. Over the years, gold has proven to be a leading asset class, delivering consistent returns even during times of economic uncertainty. The yellow metal has withstood the test of time and has maintained its value over the centuries. Its stability and ability to preserve wealth have made it a popular choice for investors seeking long-term financial security.

Diversification and Hedging

Gold is also known for its diversification benefits. By adding gold to your investment portfolio, you can reduce the overall risk and volatility of your holdings. Gold has a low correlation to other asset classes like stocks and bonds, meaning that it often moves in the opposite direction to them. This inverse relationship can provide a hedge against market downturns and economic uncertainties, helping to protect your investments during challenging times.

Inflation Hedging

Another key advantage of investing in gold is its ability to hedge against inflation. Inflation erodes the purchasing power of money, and traditional currencies may lose value over time. Gold, on the other hand, has historically maintained its intrinsic value in the face of inflation. As the cost of living rises, the price of gold tends to increase, making it an effective tool to preserve wealth and purchasing power.

can i invest in islamic compliant gold investment

how can i invest in islamic compliant gold investment

KEBOLEHPERCAYAAN DAN LIKUIDITI ETF EMAS

Store of Value

Investing in gold also offers the advantage of being a reliable store of value. Unlike other assets that can be subject to market fluctuations and economic downturns, gold retains its worth over time. It has been recognized as a form of currency for centuries and has been used as a medium of exchange since ancient times. Gold’s status as a store of value makes it a tangible and timeless investment that can serve as a safety net during uncertain economic periods.

Understanding the Malaysian Gold Market

Now that we have explored the reasons why gold is an attractive investment, let us delve into the specifics of the Malaysian gold market. Understanding the local market landscape, regulations, and types of gold investments available is crucial before making investment decisions.

Gold Market Overview

The gold market in Malaysia is well-established and offers a variety of investment opportunities for both individuals and institutions. Gold is widely recognized as a valuable asset, and its demand remains strong among Malaysians seeking to safeguard their wealth and diversify their investments. Pelaburan Emas

Regulations and Policies

To ensure the integrity and transparency of the gold market, Malaysia has established regulations and policies governing gold investments. These regulations aim to protect investors and maintain the fairness and credibility of the market. It is important for investors to be aware of these regulations and adhere to them when entering the gold market.

Types of Gold Investments

Malaysia offers a range of gold investment options to cater to different investor preferences and objectives. These include physical gold, gold certificates, gold ETFs (Exchange-Traded Funds), and gold mining stocks. Each investment type has its own unique characteristics, benefits, and risks. Understanding these options will enable investors to make informed decisions based on their investment goals and risk tolerance.

Factors to Consider Before Investing in Gold

Before diving into the world of gold investments, it is essential to consider several factors that can impact your investment journey. By evaluating your investment objectives, risk tolerance, time horizon, and financial resources, you can make more informed decisions and create a well-rounded investment strategy.

Investment Objectives

Clarifying your investment objectives is the first step in determining how gold fits into your overall portfolio. Are you investing for long-term wealth preservation, diversification, or short-term gains? Understanding your objectives will help you align your investment strategy accordingly.

Risk Tolerance

Gold, like any other investment, comes with its own set of risks. It is crucial to evaluate your risk tolerance and determine how much volatility you are comfortable with. Some investors may be more risk-averse and prefer the stability of physical gold, while others may be open to the potential rewards and risks associated with gold mining stocks.

Time Horizon

Your time horizon refers to the length of time you plan to hold your gold investments. Are you investing for the short term or the long term? Understanding your time horizon will influence your investment strategy and the types of gold investments you should consider.

Financial Resources

Lastly, evaluating your financial resources is essential before investing in gold. Consider your available capital and determine how much you are willing to allocate to gold investments. It is important to strike a balance between investing in gold and maintaining a diversified portfolio that includes other asset classes.

Different Forms of Gold Investments

Once you have assessed the factors mentioned above, it’s time to explore the different forms of gold investments available. From physical gold to gold certificates, gold ETFs, and gold mining stocks, each investment type offers unique opportunities for investors.

Physical Gold

Investing in physical gold involves purchasing gold bars or coins and holding them as a tangible asset. Physical gold offers the advantage of direct ownership and provides a sense of security for individuals who prefer to have their investments in hand. It is important, however, to consider factors such as storage, insurance, and liquidity when investing in physical gold.

Gold Certificates

Gold certificates are a form of paper gold that represent ownership of physical gold held by a financial institution or a bullion provider. They offer convenience and liquidity, as investors can trade them without the need for physical delivery or storage. Gold certificates are suitable for investors who want exposure to gold without the hassle of physical ownership.

Gold ETFs

Gold ETFs are investment funds that trade on stock exchanges and track the price of gold. They offer investors the opportunity to gain exposure to gold through the purchase of shares in the ETF. Gold ETFs provide liquidity, transparency, and diversification, making them a popular choice among investors seeking a convenient and efficient way to invest in gold.

Gold Mining Stocks

Investing in gold mining stocks involves buying shares in companies involved in gold exploration, extraction, and production. These stocks are influenced by various factors, such as the price of gold, production costs, geopolitical events, and company-specific factors. Gold mining stocks can offer potential capital appreciation and dividends, but they come with higher risks than other forms of gold investment.

Buying Physical Gold in Malaysia

For those interested in investing in physical gold in Malaysia, there are several options available for purchasing gold bars and coins. It is important to research reputable bullion dealers and retailers to ensure the authenticity and quality of your purchases.

Bullion Dealers and Retailers

Bullion dealers and retailers play a crucial role in the gold market, offering a wide range of physical gold products to investors. Look for reputable dealers who are certified and have a track record of delivering authentic and high-quality gold products. Conducting due diligence and comparing prices and services among different dealers will help you make an informed decision.

Types of Gold Bars and Coins

When buying physical gold, you will come across various types of gold bars and coins. Gold bars come in different weights and purity levels, ranging from small bars suitable for retail investors to larger bars preferred by institutions. Gold coins, on the other hand, can be purchased individually or in sets and hold both monetary and collectible value. Consider your investment objectives and budget when selecting the type of gold bars or coins to purchase.

Authenticity Verification

Given the potential for counterfeit gold products, it is essential to verify the authenticity of your purchases. Reputable bullion dealers and retailers will provide necessary certifications and verification processes to ensure the authenticity of the gold you buy. Familiarize yourself with the various security features and markings on gold bars and coins to identify genuine products.

Investing in Gold Certificates

Gold certificates offer an alternative way to invest in gold without physically owning the metal. Let’s explore what gold certificates are, their features, advantages, and disadvantages, and popular gold certificate providers in Malaysia.

Definition and Features

Gold certificates are paper documents issued by financial institutions or bullion providers that represent ownership or entitlement to a specific amount of gold. These certificates are backed by physical gold held by the issuer, providing investors with exposure to gold without the need for physical ownership. Gold certificate holders can transfer, trade, or redeem their certificates as desired.

Advantages and Disadvantages

One of the main advantages of gold certificates is their convenience and liquidity. Investors can buy and sell gold certificates without the need for physical delivery or storage. Gold certificates also provide fractional ownership, allowing investors to hold smaller amounts of gold that may not be feasible with physical gold. However, gold certificates come with counterparty risk, as the value of the certificate depends on the financial stability and integrity of the issuing institution.

Popular Gold Certificate Providers

In Malaysia, several reputable financial institutions and bullion providers offer gold certificates. It is important to choose providers that are certified and regulated to ensure the credibility and safety of your investments. Conduct thorough research, compare fees and services, and consider the track record of the provider before investing in gold certificates.

Understanding Gold ETFs

Gold ETFs, or Exchange-Traded Funds, provide investors with a convenient and efficient way to gain exposure to the price of gold. Let’s delve into the definition, structure, benefits, risks, and popular gold ETFs available in Malaysia.

Definition and Structure

Gold ETFs are investment funds that trade on stock exchanges and are designed to track the price of gold. They are structured as trust funds and hold physical gold or gold derivatives to replicate the performance of the gold market. Each share of the ETF represents a certain amount of gold, allowing investors to buy and sell shares on the stock exchange.

Benefits and Risks

Gold ETFs offer several benefits to investors, including liquidity, diversification, and cost-effectiveness. They can be traded like stocks, providing flexibility and instant market access. Gold ETFs also eliminate the need for storing physical gold and the associated costs. However, investing in gold ETFs carries risks, such as tracking error, management fees, and market volatility. It is crucial to understand these risks and conduct thorough research before investing in a specific gold ETF.

Popular Gold ETFs in Malaysia

Malaysia offers a couple of popular gold ETFs for investors seeking exposure to gold. These ETFs are traded on the local stock exchange and have gained recognition for their reliability and performance. It is advisable to evaluate the funds’ expense ratios, tracking accuracy, and liquidity before investing in gold ETFs.

Investing in Gold Mining Stocks

Investing in gold mining stocks provides investors with exposure to the gold mining industry and the potential for capital appreciation and dividends. Let’s explore the overview of the gold mining industry, the benefits and risks of investing in gold mining stocks, and popular gold mining stocks available in Malaysia.

Overview of Gold Mining Industry

The gold mining industry plays a significant role in the global economy, with both large multinational companies and small-scale miners contributing to gold production. Gold mining stocks represent ownership in these companies and offer investors exposure to the gold mining industry’s potential rewards and risks. Factors such as gold prices, production costs, geopolitical events, and company-specific factors can influence the performance of gold mining stocks.

Benefits and Risks

Investing in gold mining stocks can offer several benefits, such as the potential for high returns, dividend income, and leverage to gold prices. Mining companies with strong management, low production costs, and diversified operations can provide attractive opportunities for investors. However, investing in gold mining stocks comes with risks, including operational risks, regulatory challenges, and the volatile nature of the mining industry. It is important to conduct thorough research and assess individual mining companies before making investment decisions.

Popular Gold Mining Stocks in Malaysia

In Malaysia, investors have access to various gold mining stocks listed on the local stock exchange. These stocks represent companies involved in gold exploration, extraction, and production. It is advisable to evaluate factors such as financial stability, operational performance, and growth potential when selecting gold mining stocks to invest in.

Strategies for Successful Gold Investment

Investing in gold requires careful planning and strategic decision-making. Here are some strategies to consider when venturing into gold investments.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves regularly investing a fixed amount of money in gold over a specific period, regardless of market fluctuations. This approach allows investors to buy more gold when prices are low and fewer gold when prices are high, resulting in a lower average cost per ounce over time. Dollar-cost averaging helps to mitigate the impact of market volatility and reduces the risk of making poor investment decisions based on short-term price movements.

Portfolio Allocation

Proper portfolio allocation is essential when investing in gold. Gold should be viewed as part of a diversified investment portfolio, alongside other asset classes such as stocks, bonds, and real estate. The percentage of gold allocation will depend on factors such as investment objectives, time horizon, risk tolerance, and market conditions. Maintaining a balanced portfolio can help manage risk and optimize returns.

Balancing Risk and Return

Investing in gold involves balancing risk and return. While gold is generally considered a safe-haven asset, it is not immune to price fluctuations and market volatility. Investors should assess their risk tolerance and align their investment strategy accordingly. Higher-risk options, like gold mining stocks, may offer the potential for significant returns but can be more volatile. Conservative investors may prefer physical gold or gold ETFs for stability and long-term wealth preservation.

Selling and Liquidating Gold Investments

Eventually, the time may come to sell or liquidate your gold investments. Here are some factors to consider, methods of selling, and tax considerations when it comes to selling gold.

Factors to Consider

Before selling your gold investments, it is crucial to evaluate various factors that may influence your decision. Consider the current market conditions, price trends, and your investment objectives. If you need to raise funds or rebalance your portfolio, selling gold may be a practical choice. Assess your financial goals and consult with a financial advisor if needed.

Methods of Selling

When it comes to selling your gold investments, there are several methods to choose from. You can sell physical gold through bullion dealers or online platforms that facilitate gold trading. Gold certificates and gold ETFs can be sold through the financial institutions or brokerage firms offering these products. Consider the fees, liquidity, and convenience associated with each selling method.

Tax Considerations

Tax considerations can have an impact on your gold investment decisions, particularly when it comes to selling and capital gains tax. Familiarize yourself with the tax regulations and obligations specific to gold investments in your country. Consult with a tax professional to understand the implications and optimize your tax position.

In conclusion, investing in gold can provide numerous benefits, including historical performance, diversification, inflation hedging, and wealth preservation. Understanding the Malaysian gold market, evaluating factors before investing, exploring different forms of gold investments, and employing strategic investment approaches can help maximize the potential returns and mitigate risks associated with gold investments. Whether you opt for physical gold, gold certificates, gold ETFs, or gold mining stocks, thorough research, and proper due diligence are essential for successful gold investment.